Henry Ibsen coined the phrase, a picture is worth a thousand words, which means complex ideas can be conveyed in a single image. In finance we relate to this by using charts. Charts help with story-telling, perspective and analysis. Let’s dive into the story of COVID-19 as it stands today, April 9th, 2020 and let the charts answer some of our questions.

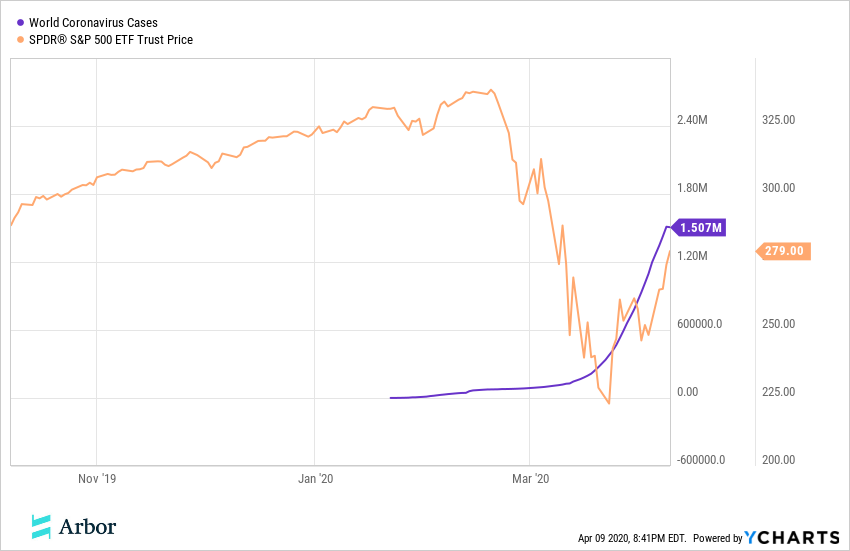

Our first chart shows the relationship between globally confirmed Coronavirus cases and our favorite index, the S&P 500.

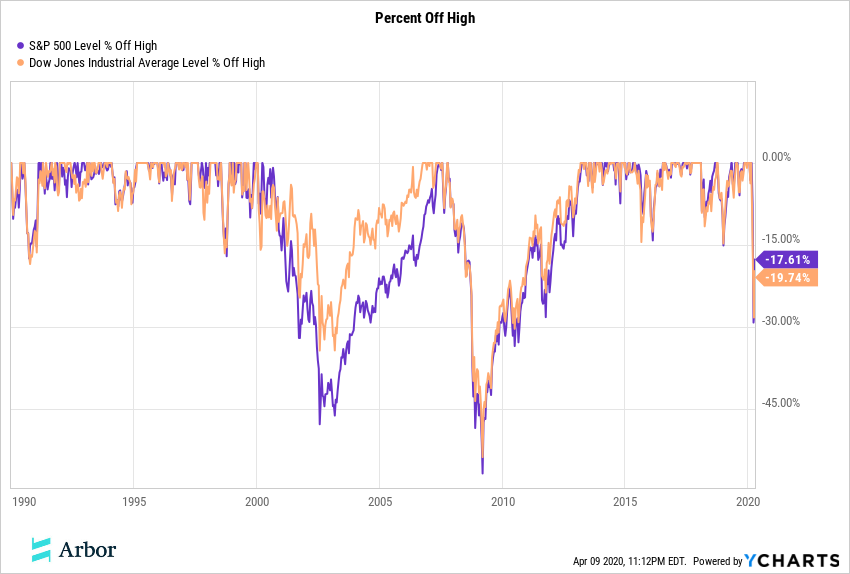

The major indexes fell by over 35% in less than 30 days. This was a historically fast single month decline in the stock market. How does it compare to the last two recessions so far?

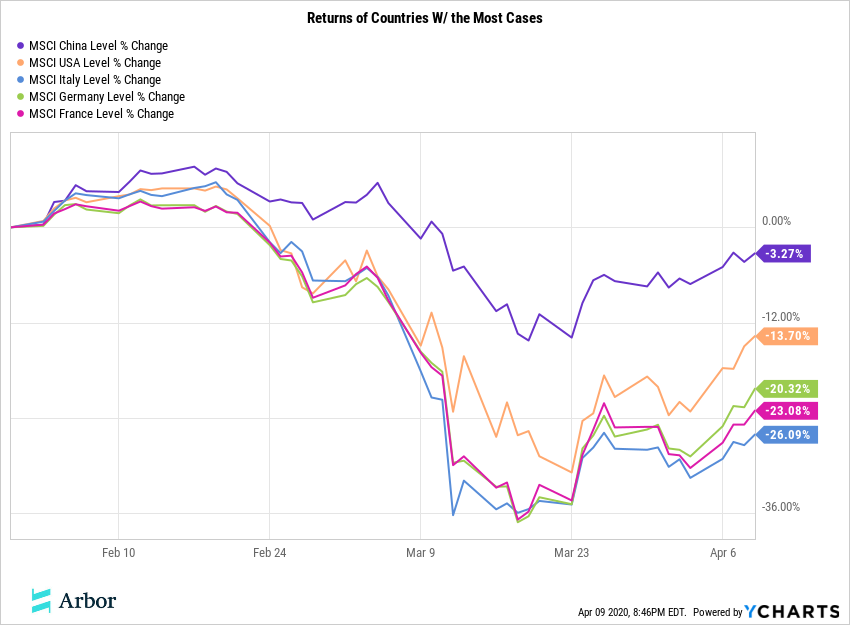

How have equity markets of the countries with the most cases performed so far?

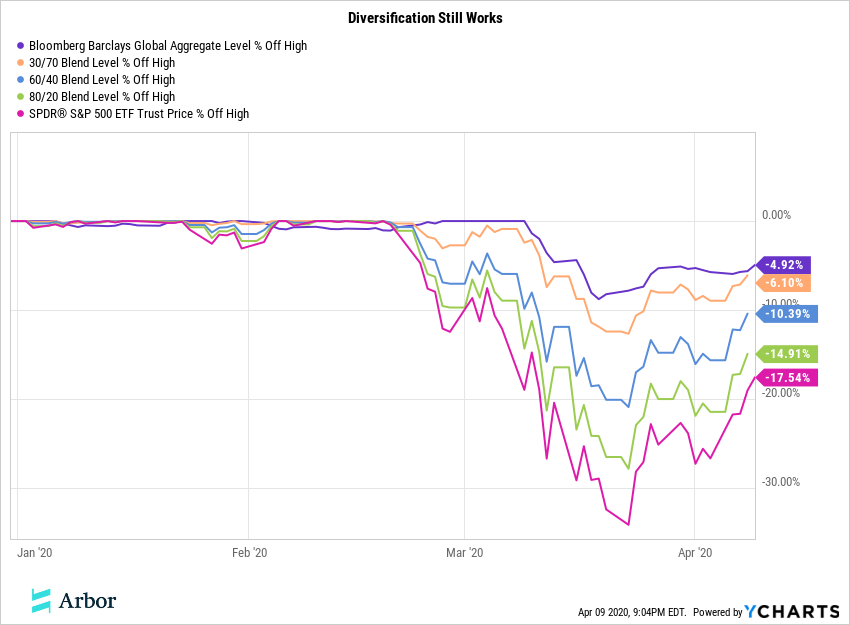

Does diversification in portfolios still work? Lets compare Barclay’s bond aggregate and the S&P 500 to a few blended portfolios.

This chart tells us that even if bonds aren’t paying the income they used to, they are still an effective hedge against volatility.

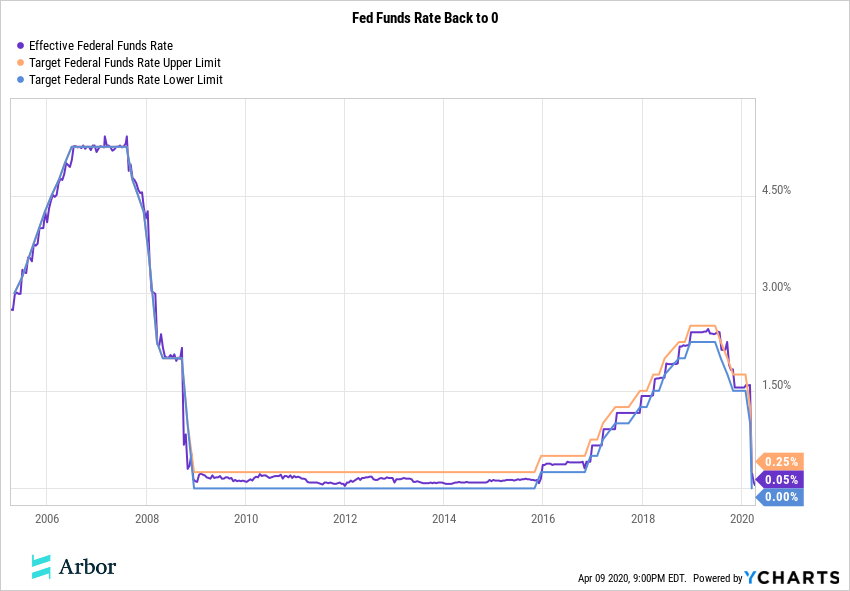

The Feds lowered the Target Federal Funds Rate again. We’ve seen this before, sort of.

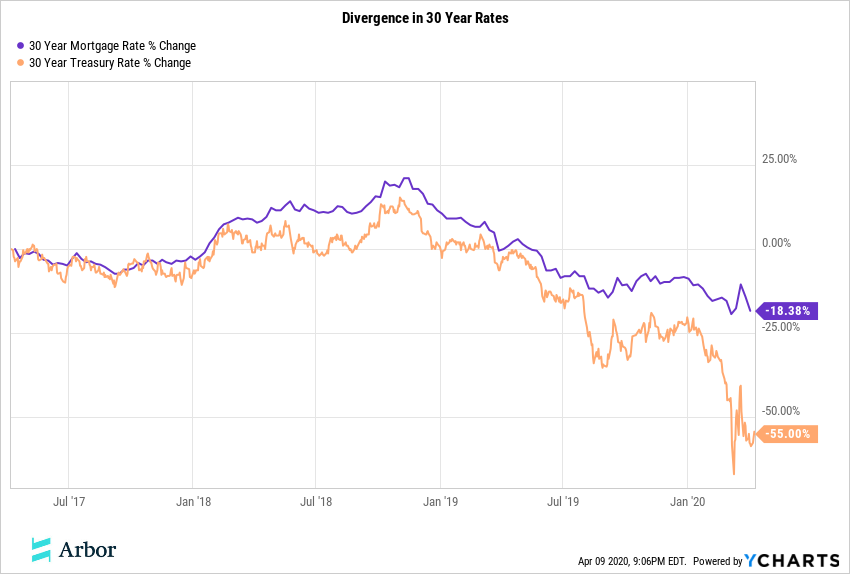

With interest rates dropping, how has it impacted mortgages rates and refinances?

Mortgage rates haven’t fallen as much as expected. This is a supply & demand issue with the amount of people applying for refinancing at the moment.

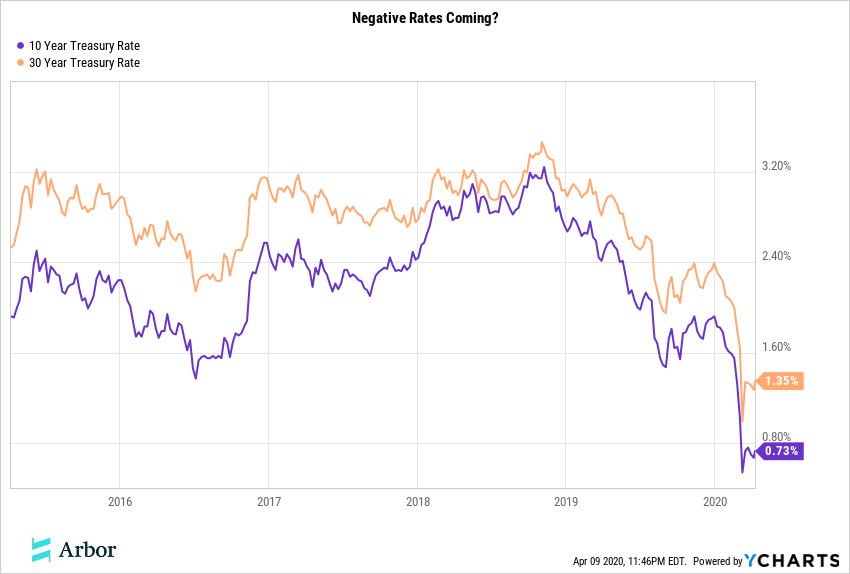

Are we headed for negative interest rates?

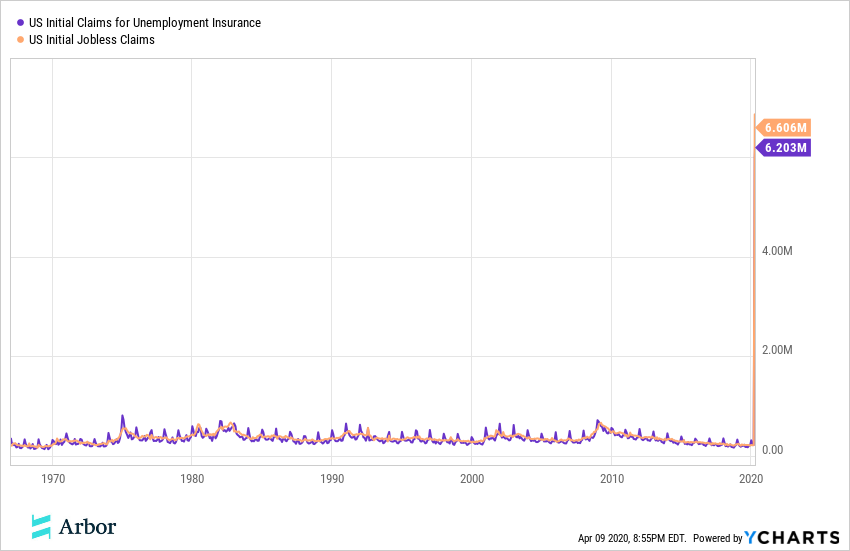

We keep hearing about staggering unemployment claims. This chart gives perspective into the unprecedented amount of initial jobless claims so far.

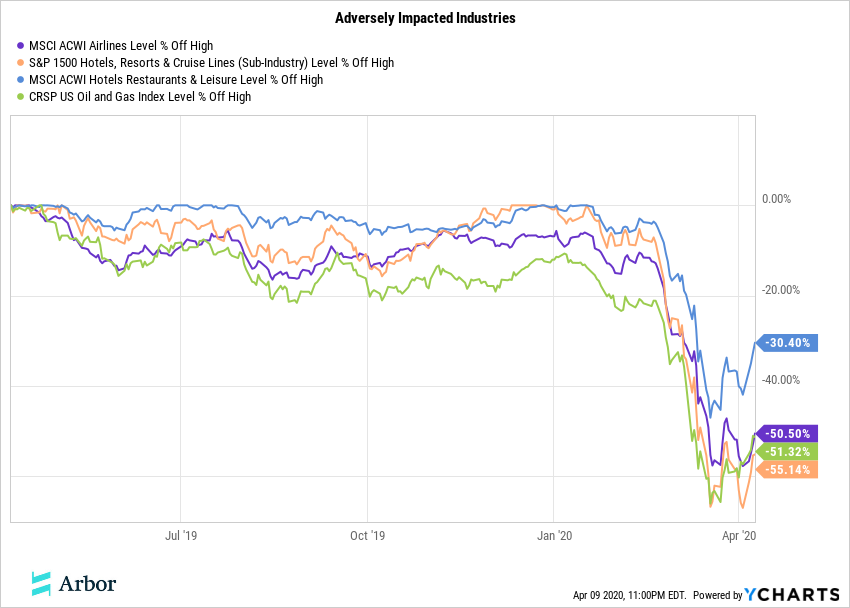

What about industries that have been severely impacted by the Coronavirus?

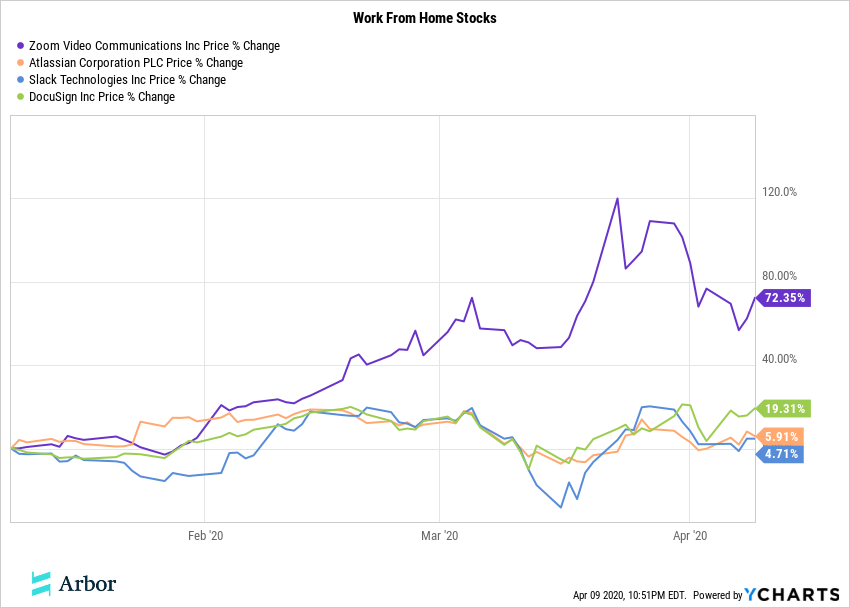

Do you keep hearing about work-from-home stocks? Here are a few that have you may have heard about.

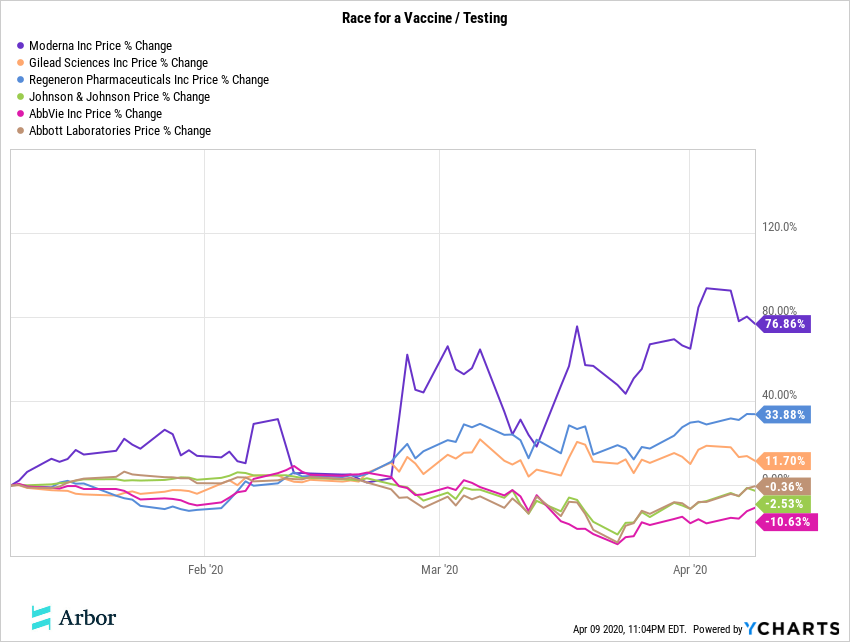

What about companies racing for a vaccine? Or companies that are working on testing kits?

If you enjoyed this approach to illustrating information, please let us know and we will continue to do our best to illustrate what is happening with the economy and finances through charts in future posts. We hope everyone is staying safe. Remember to always have a plan and if you don’t, come see us.